- Section 232 Tariffs & Investigation: Medium and heavy‑duty vehicles and parts now face duties of 10%–25% based on origin and classification. New investigations are also underway into imports such as medical equipment (PPE) and industrial machinery, which could lead to additional trade measures.

- IEEPA Fentanyl Tariff Cut: The U.S. has reduced the IEEPA tariff on certain Chinese goods (linked to fentanyl‑related trade) from 20% to 10%.

- Copper Duties: Semi-finished copper product imports are now subject to a 50% tariff on specified items.

- Transshipment Enforcement: Enforcement against transshipment to evade duties is being strengthened, with goods found transshipped potentially facing an additional 40% penalty tariff.

- Tariff Risk Assessment & Strategy: We run a detailed tariff-exposure analysis across your shipment categories and help you adjust sourcing, classification, or routing to minimize duty risk.

- Customs Compliance & Documentation: Our customs compliance team stays up to date on Section 232, IEEPA, and transshipment rules. We help ensure that your entries are properly documented, reducing audits, delays, or unexpected duties.

- Alternative Logistics Planning: We’ll work with you to explore alternative shipping strategies (e.g., adjusting origin, optimizing lead times) to mitigate cost impacts from new tariffs.

- Real-Time Supply Chain Visibility: Our tracking and visibility tools give you early insights, helping you stay ahead of changes in policies or enforcement.

Have questions about how these tariff changes affect your shipments? Our team of experts is ready to provide guidance, please Contact Us anytime. For further details, please consult the latest Tariff Update and Reciprocal Tariff List for comprehensive information.

The Federal Aviation Administration’s (FAA) flight reductions, combined with grounded cargo jets, are constraining U.S. air‑cargo capacity ahead of the holiday peak.

Importers may face delays; we help you by prioritizing shipments and offering multi‑modal or advanced‑booking options.

The White House has extended the suspension of certain reciprocal tariffs on Chinese imports as part of the ongoing U.S.-China trade arrangement

Importers sourcing from China may want to review contracts and supply plans.

CMA Terminals has acquired a 20% stake in Hamburg’s Eurogate terminal, expanding capacity and rail connectivity, potentially offering importers faster shipment options.

This could lead to greater and more reliable throughput at a key Northern European gateway.

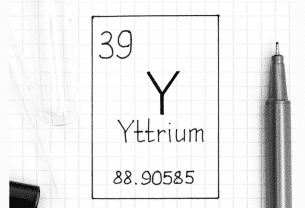

Global yttrium supplies are tightening as China increases export restrictions, creating potential supply challenges for multiple industries.

Many aerospace, electronics, and energy products rely on yttrium-based materials, meaning importers could experience longer lead times or limited availability.

U.S. import volumes are forecasted to decline through early 2026, reflecting softer near-term demand and ongoing trade uncertainty.

It is important to stay proactive with supply chain planning to maintain smooth operations, your account representative can assist you in staying ahead.

A new licensing deal with China eases immediate supply‑risk for critical minerals such as lithium, cobalt and rare earths, while the U.S. works to build out its own domestic supply chain.

Importers can expect ongoing sourcing volatility; we offer visibility, alternative routing, and proactive planning. Contact your account representative to stay ahead.