Reciprocal Tariff Update: New Rates Take Effect August 7, 2025

On July 31, the President signed an Executive Order adjusting reciprocal tariff rates on imports from dozens of countries. The new rates take effect August 7 and will impact customers shipping by ocean, air, truck, or rail.

What’s Changing:

- Country-specific tariff increases ranging from 10 to 50 percent

- 40 percent penalty rate for goods found to be transshipped to evade duties

- De minimis exemption suspended for low-value shipments under $800

- EU rates are adjusted to a minimum of 15 percent unless existing rates exceed that threshold

- Fentanyl-related goods from Canada are now subject to a 35 percent rate (USMCA goods are exempt)

Timing Matters:

To qualify for in-transit exclusions, goods must be loaded and on the final mode of transit before 12:01 a.m. EDT on August 7. For air shipments, that means cargo must depart by August 6.

Here’s How Imperative Logistics Can Support You:

Our trade compliance team is actively supporting customers with shipment reviews, HTS classification guidance, and routing strategies to minimize duty impact. If you are unsure how these changes affect your cargo or customer base, now is the time to act.

Need help navigating classifications, reviewing documentation, or rethinking sourcing options? We are here to help, contact us. For further insight, check out the latest Tariff Fact Sheet and Reciprocal Tariff List below.

View the latest Tariff Information and Reciprocal Tariffs.

Renewed tariffs are sending shockwaves through global markets, with significant implications for the U.S. dollar and trade developments that could directly affect sourcing costs, transit times, and strategic planning for companies across the supply chain.

In a volatile landscape where policy shifts can instantly disrupt freight pricing and global routing, these actions are reshaping market and economic forecasting.

Despite growing pressure from trade partners and industry groups, U.S. negotiators have indicated that the newly imposed reciprocal tariffs are unlikely to be revised or rolled back anytime soon, reinforcing the administration’s firm stance on trade reciprocity.

For importers and supply chain leaders, this signals a need for immediate and long-term planning.

The European Union has announced a six-month suspension of its retaliatory tariffs on U.S. goods, creating a temporary window of relief that could ease pressure on transatlantic supply chains and pricing strategies.

This move introduces a critical opportunity for importers and exporters to realign sourcing, evaluate long-term trade partnerships, and make the most of this policy shift.

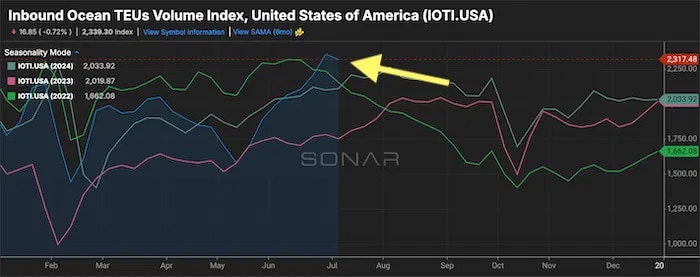

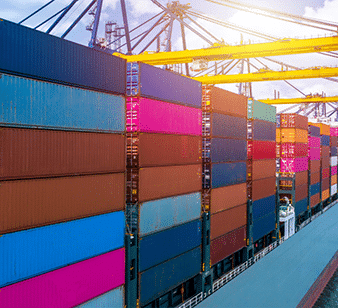

Recent shipping data shows that container rates on the Asia-to-U.S. trade lanes continue to experience significant fluctuations amid changing market conditions and shifting demand. Despite temporary pauses in trade policies, underlying factors like vessel capacity and booking volumes are driving notable shifts in freight movement.

This evolving landscape highlights the importance for supply chain teams to stay flexible, continuously reassess routing options, and optimize contract negotiations to adapt to ongoing market dynamics.

A new wave of trade policy is reshaping Asia and U.S. trade flows, driving down freight rates amid overcapacity and weakening demand at key ports like Los Angeles and Long Beach.

This shift presents a critical window for importers to reassess routing strategies, supplier coordination, and timing decisions as market conditions remain highly uncertain.

August 1st trade deadline brought new import measures affecting countries that have not finalized agreements, presenting tough decisions, freight movement, and overall cost planning throughout the supply chain.

With these measures expected to remain in place, logistics and supply chain teams must reassess supplier relationships, inventory strategies, and routing options.

Are prices going up because of tariffs? Recent trade policies have led to price increases across multiple product categories, affecting costs throughout the supply chain from manufacturers to end consumers.

These pricing changes are influencing decisions, inventory management, and overall supply chain efficiency.

As your trusted logistics partner, we’re committed to helping you reduce greenhouse gas (GHG) emissions, without sacrificing service quality, reliability, or speed.

We also offset 10% or more of our own Scope 1 and 2 emissions and collaborate with customers to offset shipment-related emissions.